Sunday, April 11, 2010

Interest Rates Have No Where to Go But Up

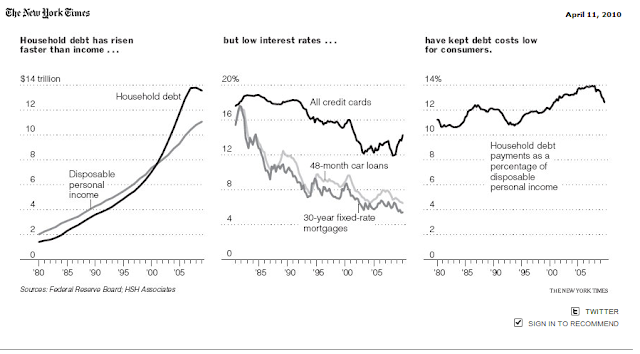

The New York Times - Even as prospects for the American economy brighten, consumers are about to face a new financial burden: a sustained period of rising interest rates.That, economists say, is the inevitable outcome of the nation’s ballooning debt and the renewed prospect of inflation as the economy recovers from the depths of the recent recession.

The shift is sure to come as a shock to consumers whose spending habits were shaped by a historic 30-year decline in the cost of borrowing.

“Americans have assumed the roller coaster goes one way,” said Bill Gross, whose investment firm, Pimco, has taken part in a broad sell-off of government debt, which has pushed up interest rates. “It’s been a great thrill as rates descended, but now we face an extended climb.”

The impact of higher rates is likely to be felt first in the housing market, which has only recently begun to rebound from a deep slump. The rate for a 30-year fixed rate mortgage has risen half a point since December, hitting 5.31 last week, the highest level since last summer.

Along with the sell-off in bonds, the Federal Reserve has halted its emergency $1.25 trillion program to buy mortgage debt, placing even more upward pressure on rates.

“Mortgage rates are unlikely to go lower than they are now, and if they go higher, we’re likely to see a reversal of the gains in the housing market,” said Christopher J. Mayer, a professor of finance and economics at Columbia Business School. “It’s a really big risk.”

Each increase of 1 percentage point in rates adds as much as 19 percent to the total cost of a home, according to Mr. Mayer.

The Mortgage Bankers Association expects the rise to continue, with the 30-year mortgage rate going to 5.5 percent by late summer and as high as 6 percent by the end of the year.

Another area in which higher rates are likely to affect consumers is credit card use.

And last week, the Federal Reserve reported that the average interest rate on credit cards reached 14.26 percent in February, the highest since 2001. That is up from 12.03 percent when rates bottomed in the fourth quarter of 2008 — a jump that amounts to about $200 a year in additional interest payments for the typical American household.

With losses from credit card defaults rising and with capital to back credit cards harder to come by, issuers are likely to increase rates to 16 or 17 percent by the fall, according to Dennis Moroney, a research director at the TowerGroup, a financial research company.

Search This Blog

Blog Archive

-

▼

2010

(66)

-

▼

April

(17)

- Derivatives Dividing Democrats

- Arizona signs tough new immigration law

- Work Force Fueled By High Skilled Immigrants

- ST. LOUIS — After a career as a corporate executiv...

- Lehman Hid Risks by Channeling Billions of Dollars...

- Distorted Jobless Numbers Loom

- Greek Debt Fears

- European Nations Offer $40 Billion to Help Greece

- Interest Rates Have No Where to Go But Up

- Bernanke Says U.S. Should Tackle Debt

- Greenspan on Capitol Hot Seat

- New Ways to Read the Economy

- Consumer Lending Sagged in February

- Criminals Prey on The Unemployed

- U.S. Airways-United Airlines Talks Intensify

- Light At The End of The Bailout Tunnel

- WSJ Current News April 5-7

-

▼

April

(17)

No comments:

Post a Comment